Worksheet 22.1 Budget Cliff – The creation of a budget is an essential step toward achieving financial stability. A budget worksheet aids you in keeping track your income and expenses, allowing you to plan your finances effectively. The budget worksheet is an excel spreadsheet that you make use of to record your monthly costs and income. In this blog we’ll explain what a budget worksheet is as well as the benefits of using one, and the steps to make one.

Why use a Budget Worksheet

Utilizing a budget worksheet offers many benefits, including:

- It helps you take control of your finances

- It lets you keep track of your expenses and income

- The tool can help you pinpoint areas where you can cut your spending

- Aids you to plan for future expenses

- It helps you save money

- You can see exactly where your money goes

How do you create a budget Worksheet

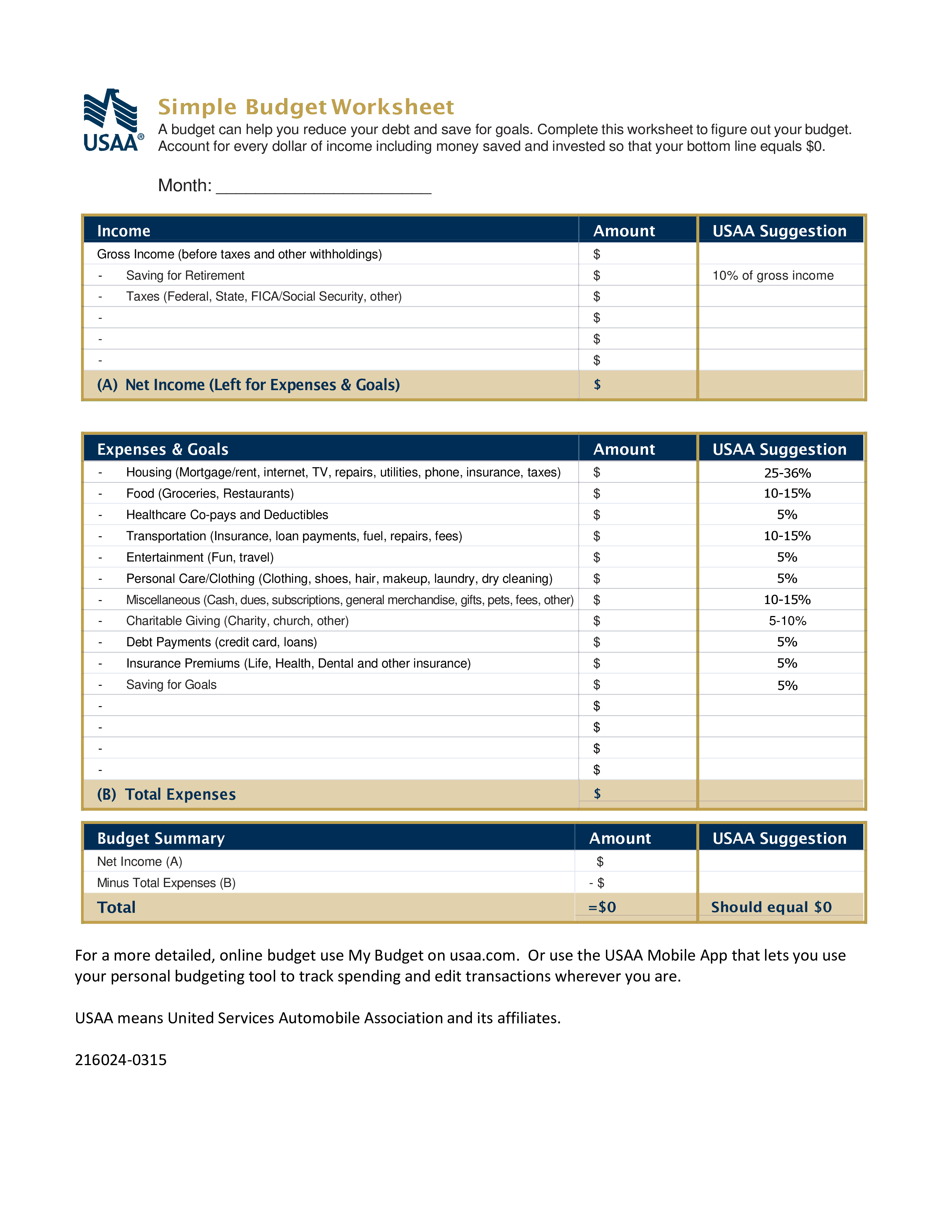

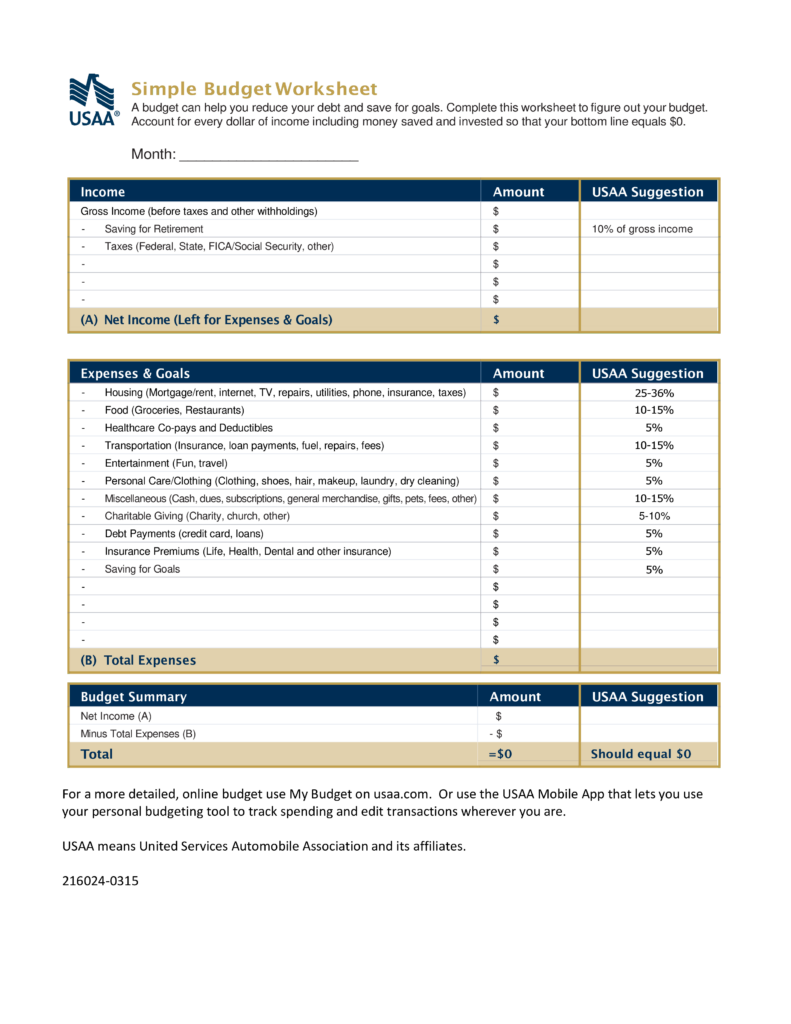

The process of making a budget spreadsheet is simple and straightforward. Use these easy steps:

- Take all your financial records, including your income, bills and expenditures.

- Create a spreadsheet . Or, you can use a template for a budget worksheet.

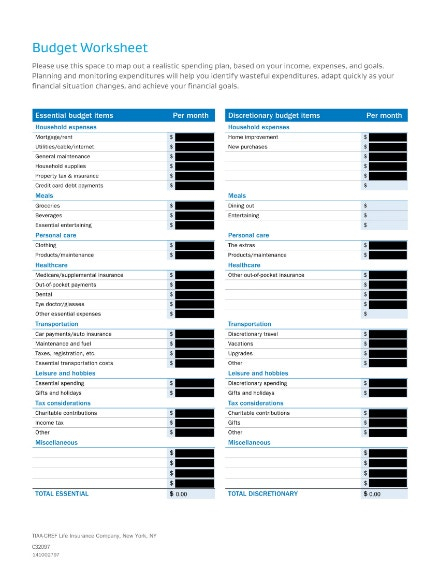

- Separate your expenses into segments, for example, groceries, transportation, housing and entertainment.

- Give a budget to each category dependent on your income and expenses.

- Track your expenses throughout the month and modify your budget if necessary.

Top Tips for using an Budget Worksheet

To get the most value out that budget worksheet adhere to these guidelines:

- Be realistic when setting your budget

- Review your budget regularly and make adjustments as necessary

- It is important to categorize your expenses so that you pinpoint areas where you could cut costs.

- Use budgeting tools such as budgeting apps, to help you track your expenditures

- Create financial goals and then use the budget worksheet that you have created to help you achieve them

Conclusion

The creation and use of a budget worksheet is a critical step to achieving financial stability. By using a budget worksheet it is possible to gain control of your finances, monitor your income and expenses and prepare on the long-term. Be sensible when creating your budget and review the budget regularly. With these strategies, it is possible to use an expense worksheet to monitor your personal financial situation.