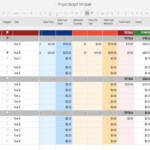

Monthly Budget Small Buisness Worksheet – The creation of a budget is an essential step toward achieving financial stability. A budget worksheet aids you in keeping track your income and expenses by allowing you to manage your finances with ease. The basic concept behind a budget worksheet is an Excel spreadsheet you can use to keep track of your month-to-month expenditures and income. In this blog post we’ll explain the purpose of a budget worksheet, why you should use one, and the steps to create one.

Why use a Budget Worksheet

A budget worksheet can provide numerous benefits, including:

- Aids you to take control of your finances

- This software allows you to track your expenses and income

- Aids you to identify areas in which you can cut back on spending

- This will help you plan your future expenses

- It will help you save money.

- Allows you to see the direction your money is taking

How to create a Budget Worksheet

A budget worksheet to create is simple and straightforward. Just follow these steps:

- Find all the financial details you can including your income, bills and expenditures.

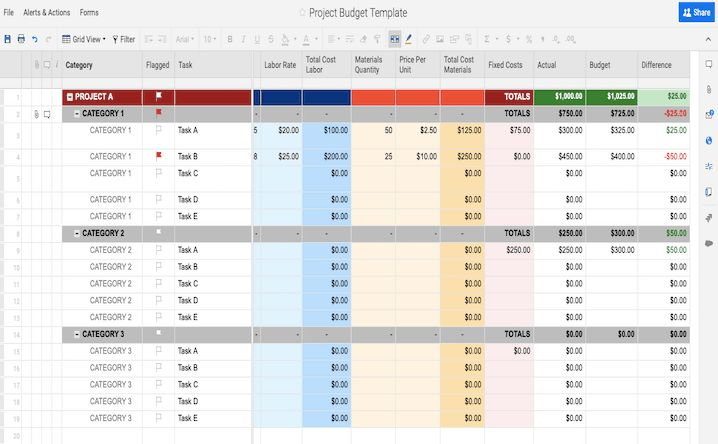

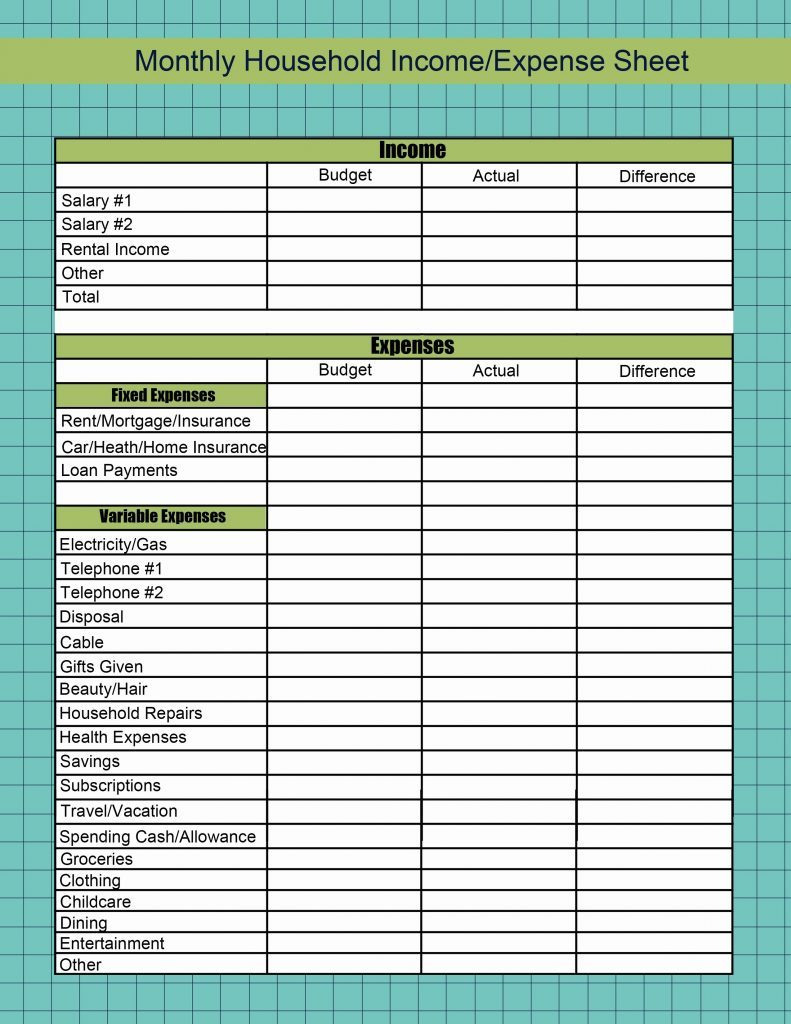

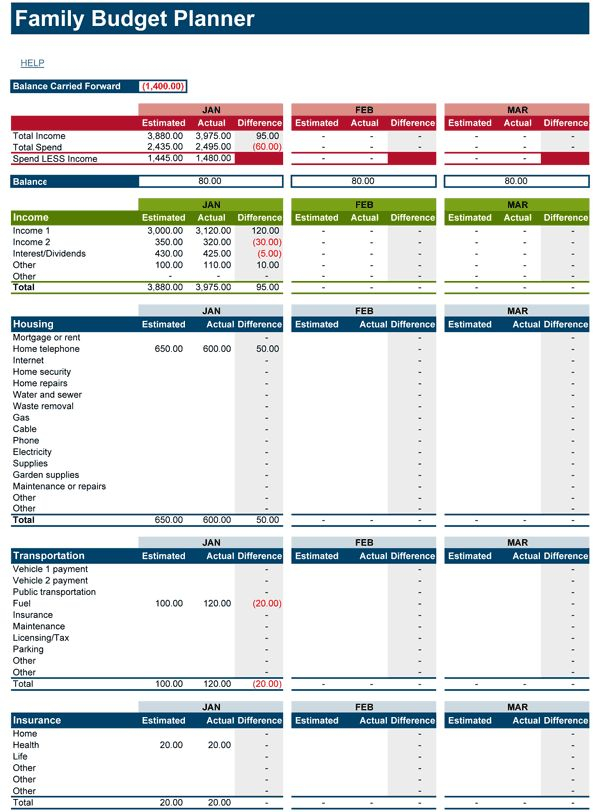

- Make a spreadsheet using a template for a budget worksheet.

- Divide your expenses into groups, like the cost of housing, transportation, groceries, and entertainment.

- Give a budget to each category based on your income and expenses.

- Track your expenses throughout the month and adjust the budget as needed.

Some Tips for Using an Excel Budget Worksheet

To make the most from your worksheet on budget, keep these in mind:

- Be realistic when you set your budget

- Revise your budget often and make adjustments if needed.

- Categorize your expenses to help your identify areas where you could cut costs.

- Utilize budgeting software, such as budgeting applications, in order to keep track of your expenditures

- Make financial goals, and use your budget worksheet to help to achieve them.

Conclusion

In the creation and use of a budget worksheet is a vital step towards financial stability. Utilizing a budget worksheet lets you take charge of your finances, keep track of the income and expenses you incur, and plan into the future. Remember to be flexible when setting the budget, and also to evaluate it regularly. With these advice, it is possible to use a budget worksheet to manage your personal finances.