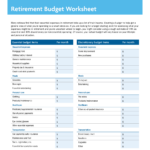

Kiplinger Retirement Budget Worksheet – In the process of creating a budget, it is a vital step to achieve financial stability. A budget worksheet is a tool that will help you keep track of your income and expenses as well as help you plan your finances effectively. A budget worksheet is an Excel spreadsheet you can create to record your monthly expenses and earnings. In this blog post this post, we’ll describe the purpose of a budget worksheet and the reasons you should have one, and how you can create one.

Why use a Budget Worksheet

Utilizing a budget worksheet comes with many benefits, including:

- This tool helps you manage your finances

- You can track your income and expenses

- Lets you know where you can cut back on spending

- Helps you plan for future costs

- Saves money

- You can see exactly where your money is going

How do you create a budget Worksheet

A budget worksheet to create is simple and simple. The steps are simple:

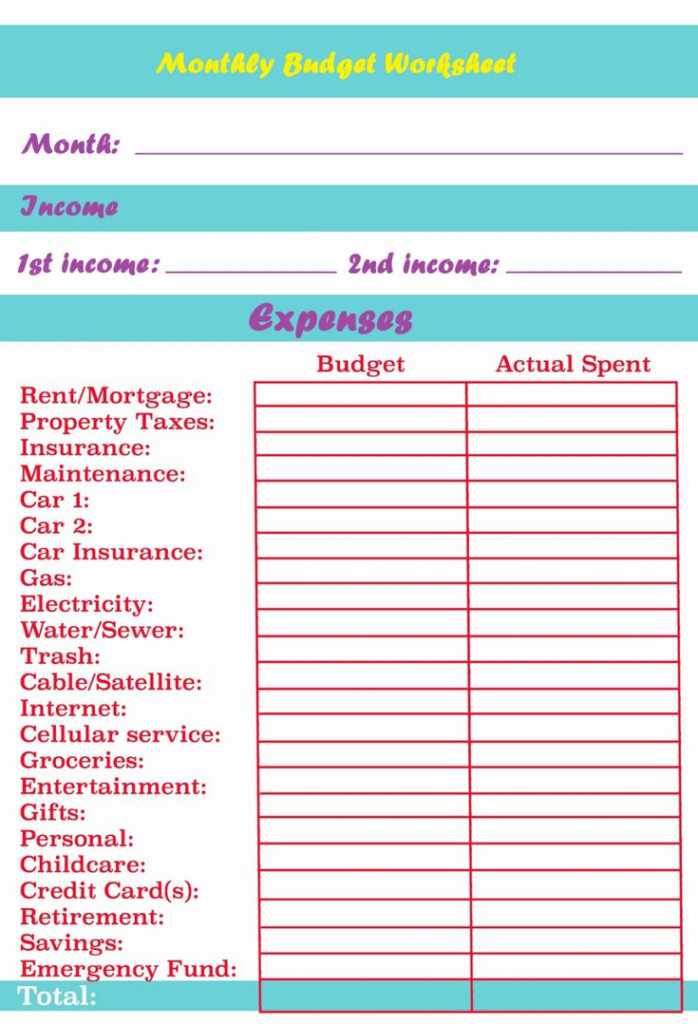

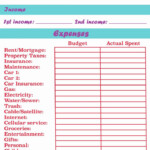

- Get all your financial details, including your income, bills and expenses.

- Use a spreadsheet to create a budget or an existing budget worksheet template.

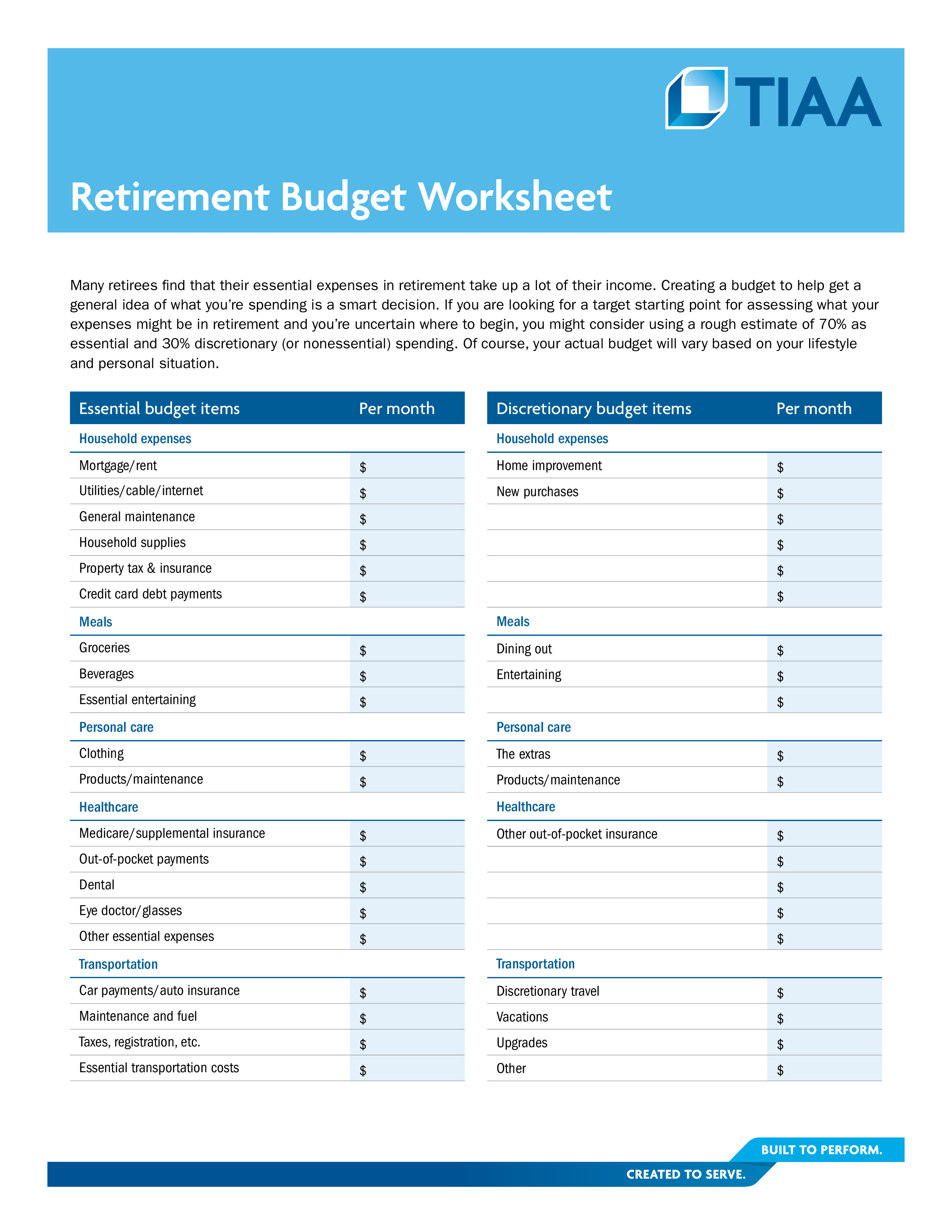

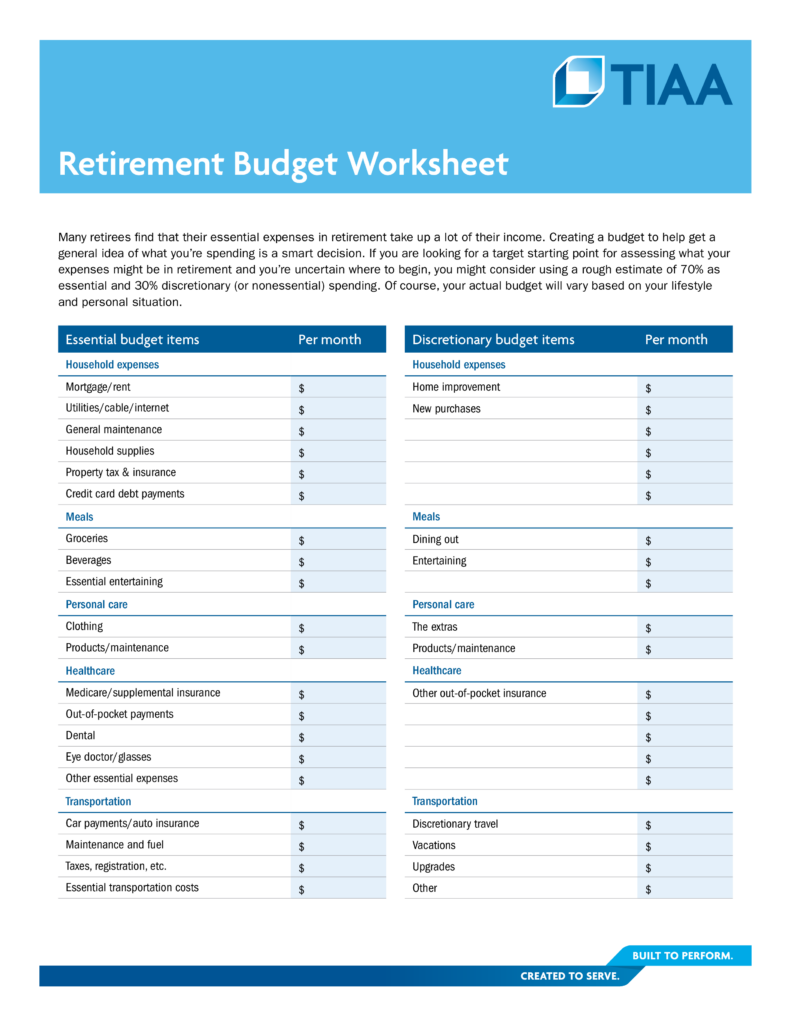

- Split your expenses into categories, such as transportation, food, housing and entertainment.

- Input a budget into each category based on your income and expenses.

- Record your expenses over the course of each month, and adjust your budget as needed.

Top Tips for using A Budget Worksheet

To make the most from your worksheet on budget be sure to follow these steps:

- Be realistic when setting your budget

- Review your budget regularly to make adjustments as required.

- Sort your expenses into categories to help you identify areas where it is possible to cut back

- Make use of budgeting tools, such as budgeting applications, in order to keep track of your expenses

- Make financial goals, and use your budget template to help you meet them.

Conclusion

Creating and using a budget worksheet is an important step towards achieving financial stability. By using a worksheet to budget lets you take charge of your finances, track your income and expenses, and make plans into the future. Be real when you set your budget and make sure you review it on a regular basis. By following these guidelines, you can use an expense worksheet to monitor your personal financial situation.