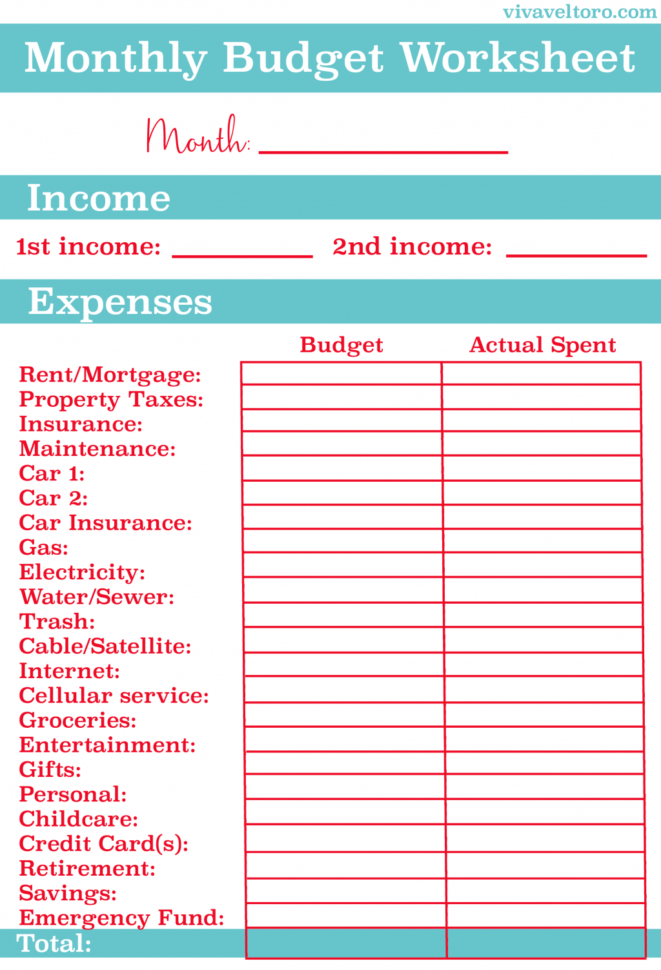

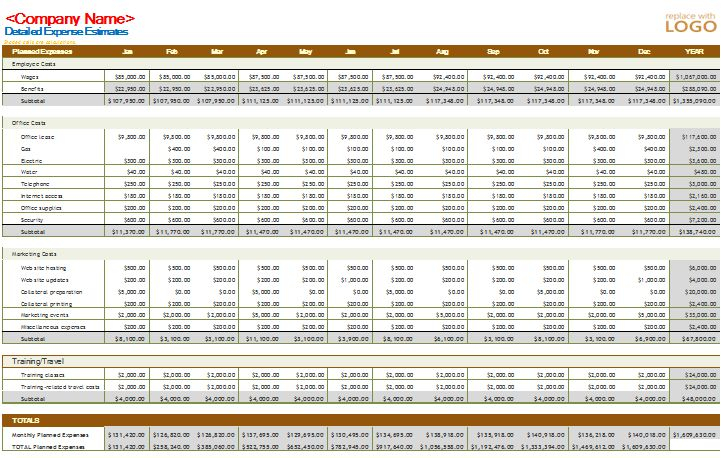

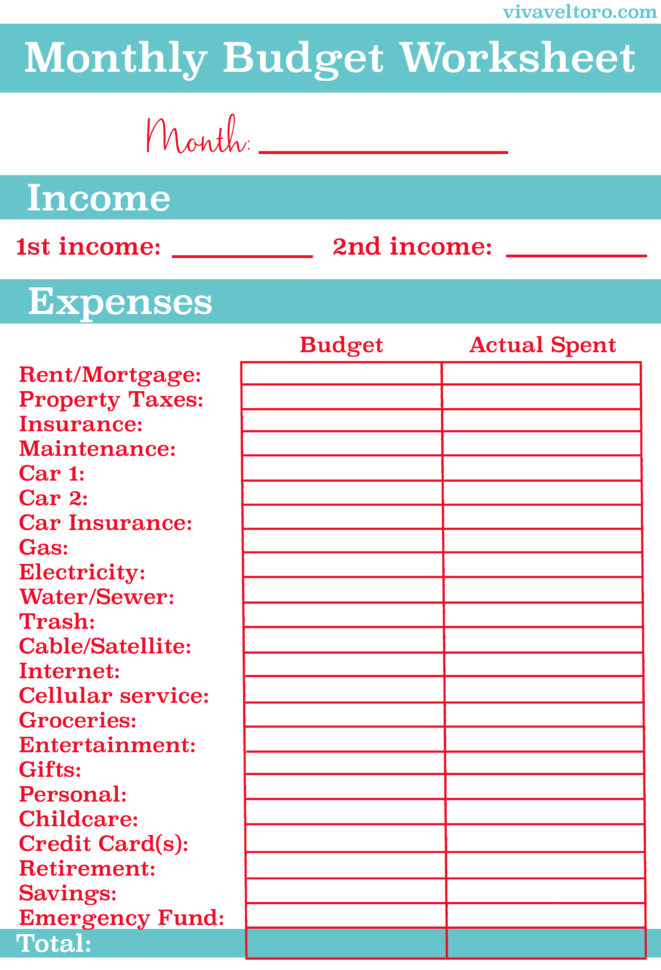

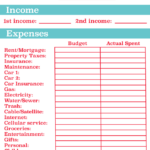

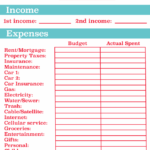

Free Budget Worksheet For Families – Planning a budget is the essential step toward achieving financial stability. A budget worksheet helps you keep track your expenses and income, allowing you to plan your financial affairs effectively. A budget worksheet can be described as an Excel spreadsheet you can make use of to record your monthly expenditures and income. In this blog we’ll explain the definition of a worksheet for budgeting and why you should make use of one, and then how to create one.

Why use a Budget Worksheet

Utilizing a budget worksheet comes with many benefits, including:

- Helps you gain control of your finances

- Allows you to track your income and expenses

- The tool can help you pinpoint areas where you could cut back on spending

- Can help you plan for future expenses

- It will help you save money.

- You can check the exact location of your money

How to create a Budget Worksheet

Making a budget worksheet is simple and straightforward. The steps are simple:

- Get all your financial details such as your earnings, bills, and expenses.

- Use a spreadsheet to create a budget or templates for budgeting.

- Separate your expenses into various categories, such a the cost of housing, transportation, groceries and entertainment.

- You should assign a budget to each category depending on your income and expenses.

- You should track your expenses over the month and alter your budget whenever necessary.

Best Tips to Use an Budget Worksheet

For the best use you budgeting worksheet, use these suggestions:

- Be realistic when you set your budget

- Revise your budget each month and make changes as necessary

- Classify your expenses so that your identify areas where you can cut back

- Utilize budgeting tools, like budgeting apps to track your expenses

- Set financial goals and utilize your budget worksheet to help you achieve them

Conclusion

Setting up and using a financial worksheet is an essential step toward achieving financial stability. By using a worksheet to budget that you can take control of your finances, keep track of your expenses and income, and prepare to plan for your future. Remember to be realistic when setting your budget , and remember to revisit it often. If you follow these steps, you can make a successful use of your budget worksheet to keep track of your personal finances.