Financial Budget Worksheet Excel – The creation of a budget is an vital step to achieve financial stability. A budget worksheet helps you keep track of your income and expenses and allows you to manage your finances in a way that is efficient. A budget worksheet is one of the spreadsheets you could use to keep track of your month-to-month expenses and earnings. In this blog post we’ll explain the purpose of a budget worksheet as well as the benefits of using one, and also how to create one.

Why use a Budget Worksheet

It is beneficial to use a budget planner. It has numerous benefits, among them:

- It helps you take control of your finances

- Helps you track your income and expenses

- Helps you identify areas where you can reduce your spending

- Can help you plan for future costs

- This app helps you save money

- Allows you to see exactly where your money goes

How do you create a budget Worksheet

It is simple and simple. Follow these easy steps:

- Keep track of all your financial information including your earnings, bills, and expenses.

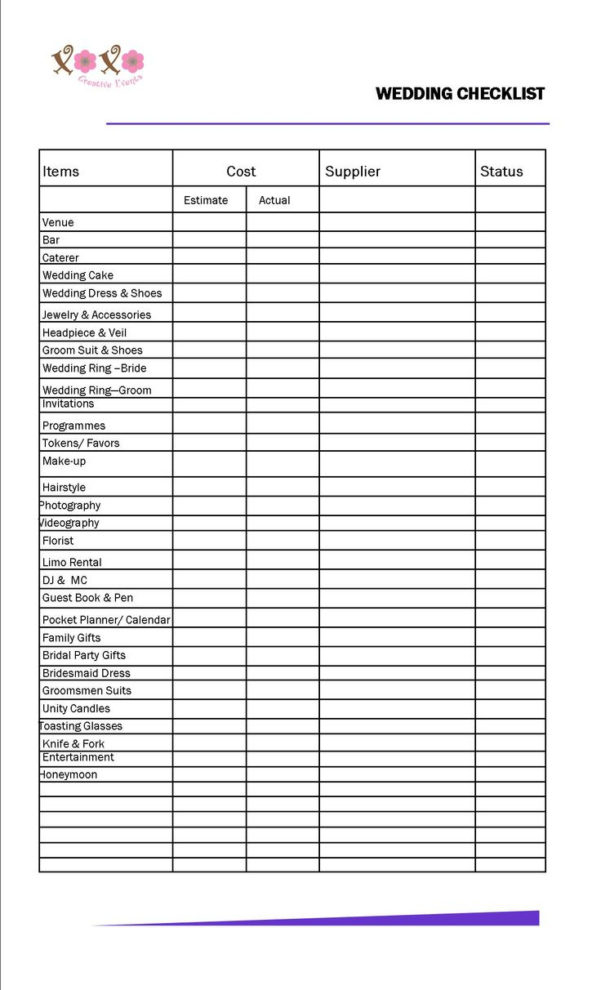

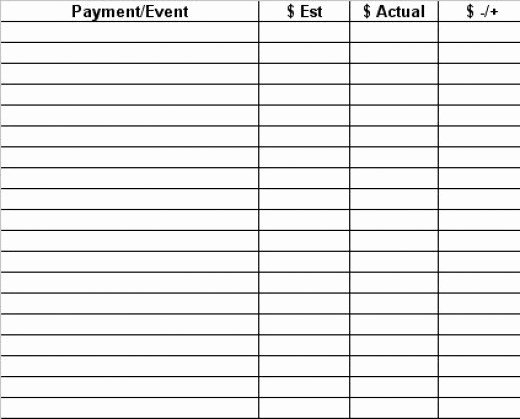

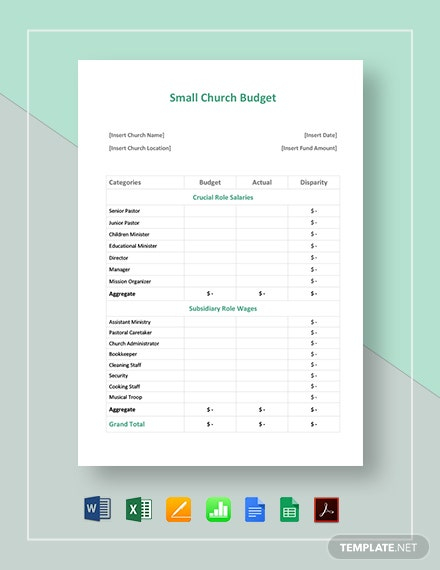

- Create a spreadsheet or utilize the budget worksheet template.

- You can divide your expenses into sections, such as grocery, transportation, accommodation, and entertainment.

- Affix a budget per category according to your income and expenses.

- Track your expenses throughout the month . Adjust your budget whenever necessary.

The Best Tips to use A Budget Worksheet

For the best use from your worksheet on budget make sure you follow these rules:

- Be realistic when you set your budget

- Revise your budget each month and make any necessary adjustments

- It is important to categorize your expenses so that you pinpoint areas where you can reduce your spending.

- Use budgeting tools, such as budgeting apps, in order to keep track of your expenditures

- Create financial goals and then use the budget worksheet you created to help to achieve them.

Conclusion

Creating and using a budget worksheet is essential to achieving financial stability. By using a budget worksheet it is possible to gain control over your finances, record the income and expenses you incur, and make plans on the long-term. Be practical when setting your budget and ensure you check the budget regularly. With these strategies, it is possible to use the worksheet on budgets to track your personal finances.