Bsa Financial Management Budget Worksheet – Making a budget is a essential step toward achieving financial stability. A budget worksheet can help you track your expenses and income while allowing you to organize your finances efficiently. A budget worksheet is essentially an excel spreadsheet that you be able to use to record your monthly spending and earnings. In this blog post we’ll explain what a “budget” worksheet, why you should use one, and how you can create one.

Why use a Budget Worksheet

The use of a budget worksheet provides numerous advantages, which include:

- Helps you control your finances

- You can track your income and expenses

- It helps you determine areas where you can cut back your spending

- You can plan ahead for future expenses

- This app helps you save money

- You can see the direction your money is taking

How to create a Budget Worksheet

The process of making a budget spreadsheet is simple and simple. Make sure to follow these easy steps:

- Find all the financial details you can including your income, bills, and expenditures.

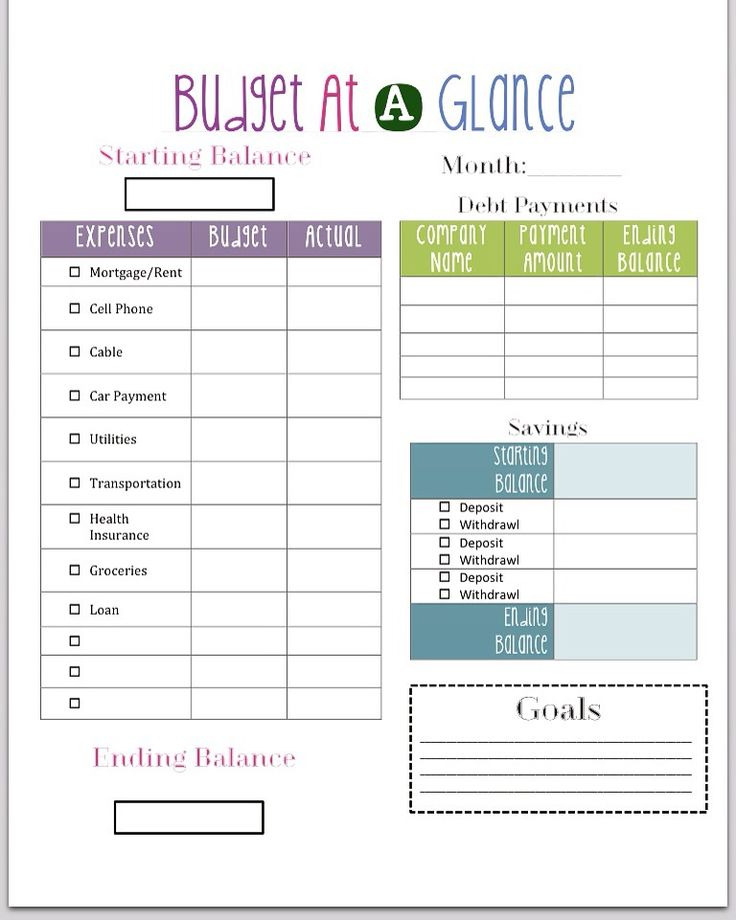

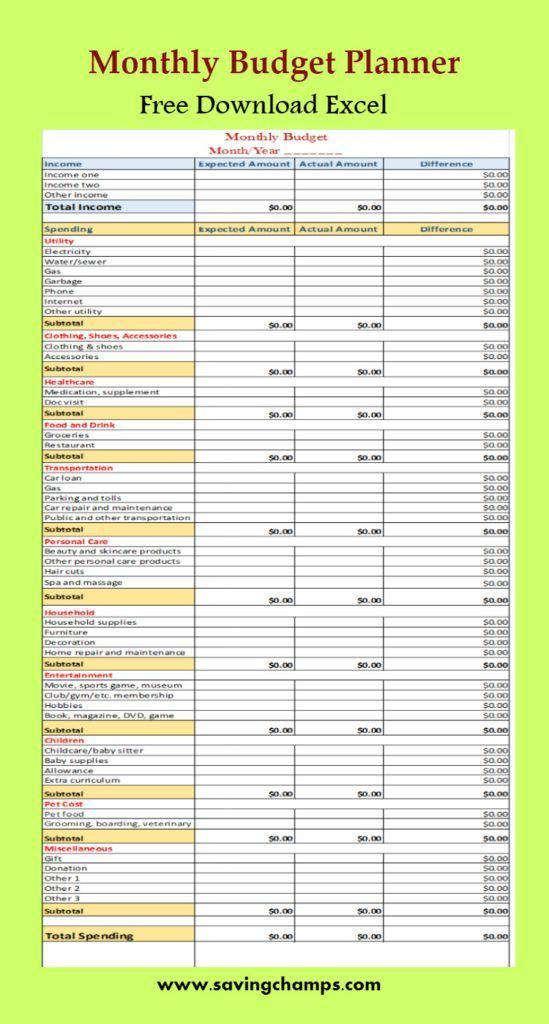

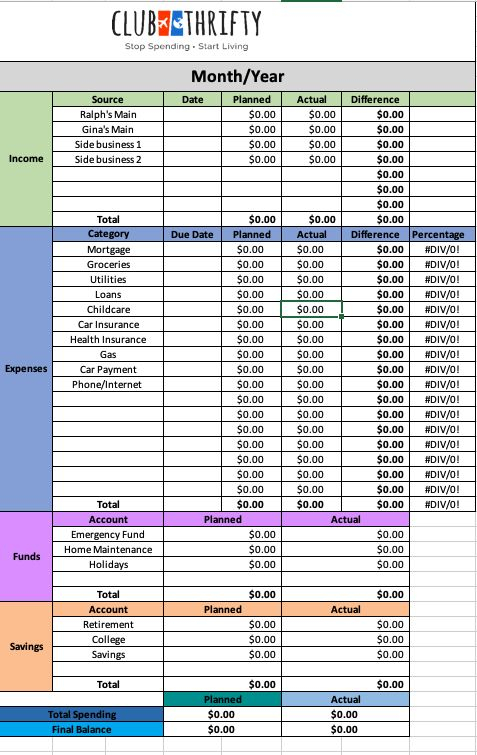

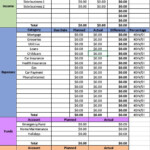

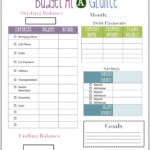

- Create a spreadsheet or utilize an existing budget worksheet template.

- Dividing your expenses into different categories, including food, transportation, housing, and entertainment.

- Input a budget into each category based on your income and expenses.

- You should track your expenses over each month, and adjust your budget as required.

Best Tips to Use your Budget Worksheet

To get the most benefit that budget worksheet use these suggestions:

- Be realistic when setting your budget

- Revise your budget every few months and make necessary adjustments

- Classify your expenses so that identify areas where you can reduce your spending.

- Use budgeting tools like budgeting apps that will help you track your expenditures

- Make financial goals, and use your budget template to help you meet them.

Conclusion

Utilizing a budget worksheet is an essential step to achieving financial stability. Through a budget worksheet helps you gain control over your finances. You can track your income and expenses, and plan in the near future. Remember to be practical when setting your budget , and be sure to check the budget regularly. If you follow these steps, it is possible to use an expense worksheet to monitor your personal financial situation.