Aamc Budget Worksheet – The creation of a budget is an essential step to attain financial stability. A budget worksheet helps you keep track your expenses and income as well as help you plan your financial affairs effectively. A budget worksheet can be described as an excel spreadsheet that you create to record your monthly expenses and income. In this blog this post, we’ll describe what a “budget worksheet” is it, the reason you should use one, and how you can create one.

Why use a Budget Worksheet

A budget worksheet can provide many advantages, such as:

- This tool helps you manage your finances

- Allows you to keep track on your income and expenses

- Finds areas in which you can cut your spending

- Aids you to plan for future expenses

- You can save money

- You can see exactly where your money is going

How do you create a budget Worksheet

In creating a budgeting worksheet, it’s simple and easy. Simply follow these steps:

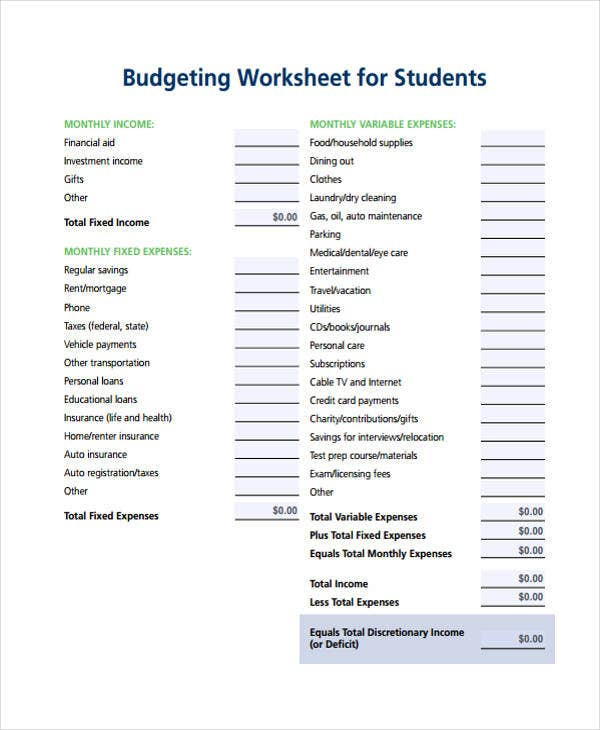

- Gather all your financial information, including your income, bills, and expenditures.

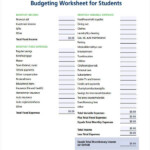

- Create a simple spreadsheet or employ the budget worksheet template.

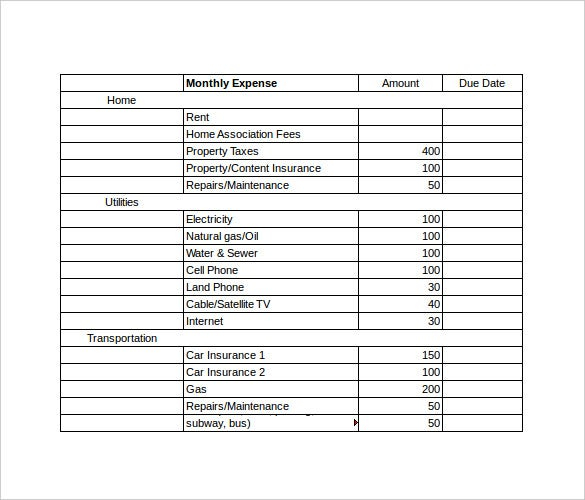

- Divide your expenses into segments, for example, transport, housing, groceries, and entertainment.

- Affix a budget per category depending on your income and expenses.

- Keep track of your expenses throughout the month , and then adjust your budget as required.

Some Tips for Using an Budget Worksheet

In order to get the most of your budget worksheet take these steps:

- Be realistic when you set your budget

- Revise your budget each month and make adjustments as necessary

- Label your expenses in order to help you determine areas in which you can trim costs.

- Utilize budgeting software, such as budgeting apps, to track your spending

- Set financial goals and utilize your budget worksheet in order to help you achieve them

Conclusion

Implementing and using a Budget worksheet is a vital step toward achieving financial stability. By using a financial worksheet it is possible to gain control of your finances. You can also track your income and expenses, and prepare on the long-term. Make sure to be sensible when creating your budget , and be sure to check it frequently. With these strategies, you can use the worksheet on budgets to track your personal financial situation.